sports betting in ct taxes

Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget. Any unpaid taxes will accrue interest.

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Since PASPA was repealed by the Supreme.

. Income from 20001 to. If you are over the age of 21 you are permitted to gamble in. The legal gambling age in Connecticut is 21 and this is likely to apply to retail and online sports betting.

12000 and the winner is filing. You must be 21 years of age to participate in casino games but then again. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income.

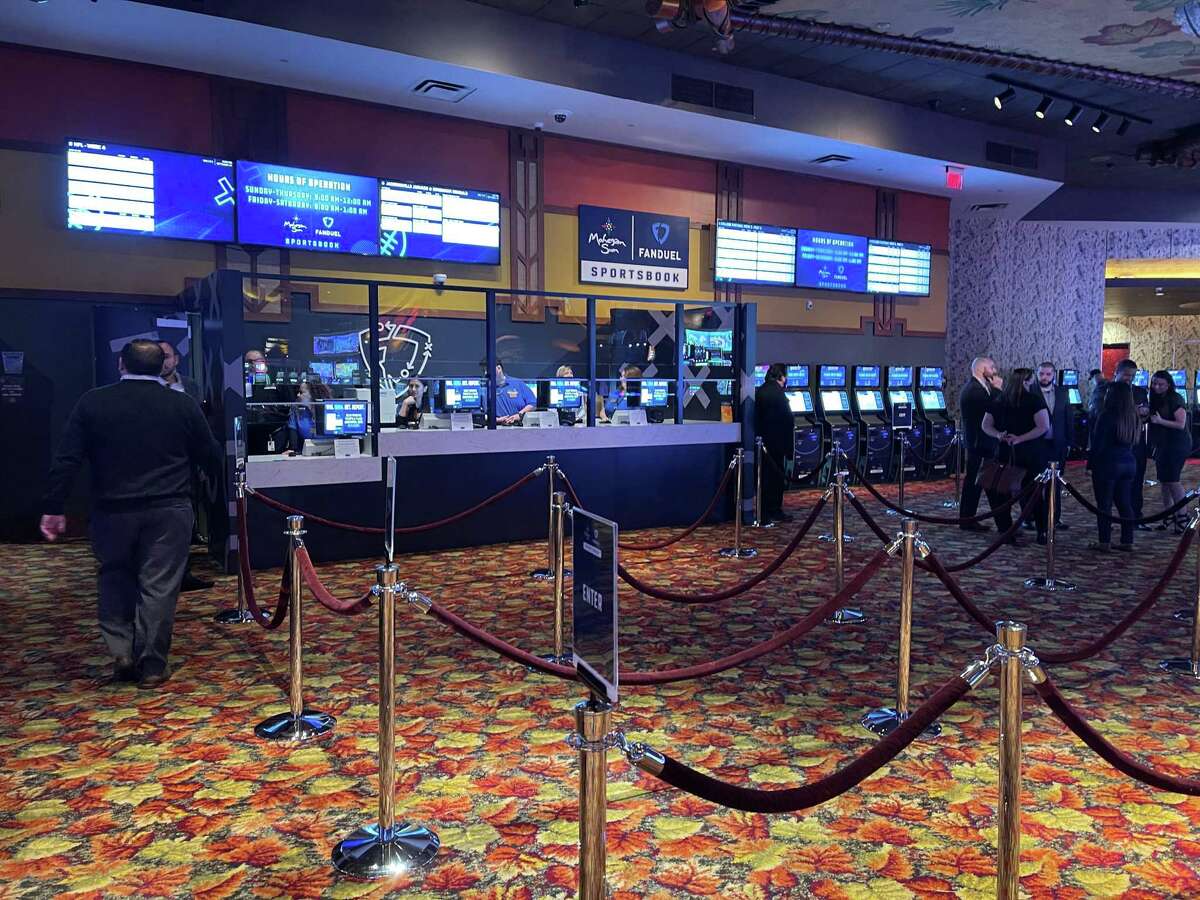

The legalization of sports betting in Connecticut State is close and soon people will be able to visit physical sportsbooks to place their wager. Online Gambling laws in Connecticut explained. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

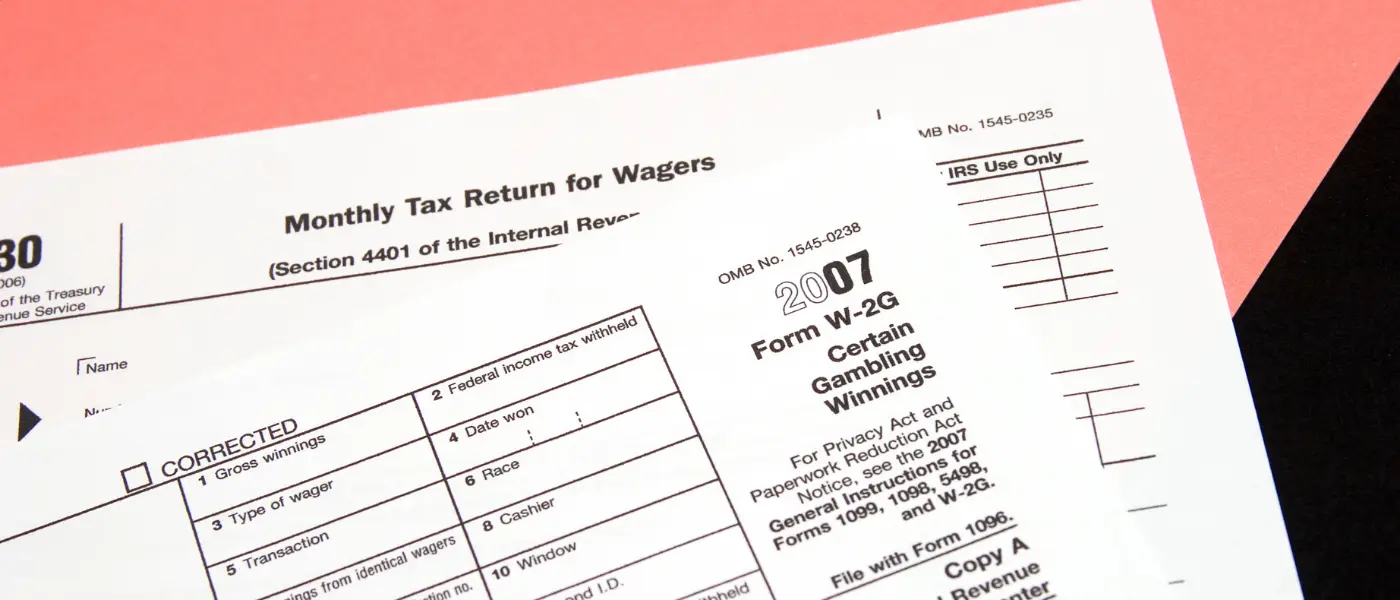

CT Sports Betting Taxes. Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds.

Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. How much revenue will CT sports betting generate. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026.

Income up to 20000 are taxed at 14. Well the NJ sports betting tax rate differs depending on your income and weve laid out the tax rates below. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds.

This season is expected to be the most. Those numbers will increase with. The IRS code includes cumulative winnings from.

Last month the state received 501516 in tax payments on sports betting revenue from the three entities licensed to offer sports betting in Connecticut. When sports betting becomes legal in the state. Winnings From Online Sports Sites Are Taxable.

The tax revenue gained through regulated sports betting is the primary reason behind its legalization. 12000 and the winners filing status for Connecticut income. Is the 20 tax the state proposes to collect from the casinos.

The state will collect taxes of. In the world of gambling there is only one certainty. The gambling laws in Connecticut are pretty straightforward.

Tax payments from sports betting operators in February were the lowest yet. Mohegans agree to sharing sports betting with CT Lottery by Mark Pazniokas March 2 2021 March 5 2022. Its the lowest tax figure.

Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. The state taxes sports betting revenue each month from three master licensees.

Connecticut Gambling Revenue Highs And Lows In February

Gov Hochul Reports Record New York Online Sports Betting Tax Revenue

Online Sports Betting Is Live In Connecticut Ctinsider

Assemblyman Pretlow Calls For Lower New York Sports Betting Tax Rate

Ct House Of Representatives Passes Legislation Regarding Online Gaming Sports Betting In State Fox61 Com

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Ct Sports Betting To See Limited Launch This Week Fox61 Com

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

![]()

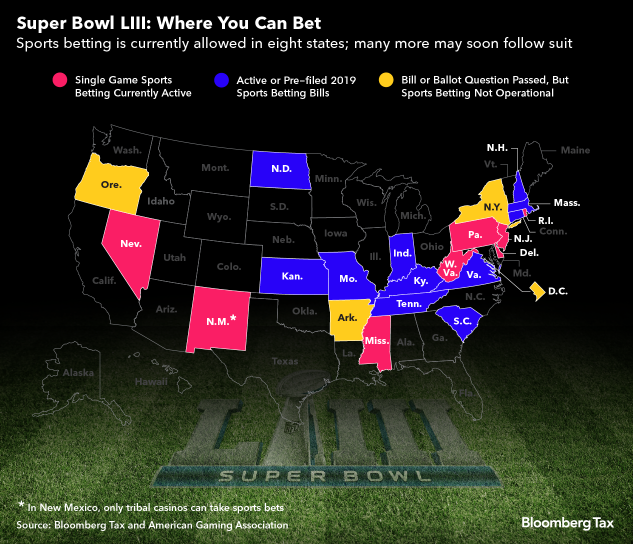

When Will My State Legalize Sports Betting Map Of Sports Gambling Legislation Across The Us

Online Sports Betting Is Live In Connecticut Ctinsider

How To File Your Taxes If You Bet On Sports Explained

Betting And Betting Ct S Expanded Gambling Yields Billions

New York Sets Sports Betting Sets Tax Revenue Record

Information For Taxes Ct Playsugarhouse

Super Bowl Gamblers Here S Where You Can Bet How You Ll Be Taxed

Connecticut Sportsbooks Sports Betting Best Guide 2022

Horse Racing Betting Tax Rules Are Taxes Owed On Winnings

Connecticut Sports Betting Operators Beat Out Their Bettors In August